*Author note: This only applies to Malaysian properties

Serviced Apartment on a Commercial Title Land

Traditionally, apartments are built on residential title lands without much facilities. As our nation develops, residential lands are becoming rarer and the only ones not being developed are usually in the remote area.

Today, many newer type serviced apartment, SoHo type condominium are being built on commercial title land. As a result, property buyers especially investors are concerned about the difference in Quit Rent, Assessment Rate, Electricity, and Water charges. If you are an investor yourself, should you be concerned?

Let’s do an analysis below.

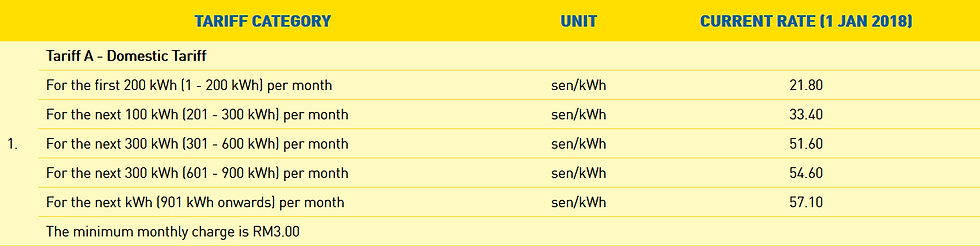

Electricity – Tenaga National Berhad

Electricity charge is based on the tariff rate for each category and typically cheaper on a residential property.

Residential Properties

Commercial Properties

Serviced Apartment or SoHo is categorised as low voltage commercial premises

As you can see, for the first 200kWh the residential properties are charged RM0.218 per kWh, while the commercial properties are charged RM0.435, double the amount of the domestic properties.

Water

Usually the water charges for a commercial property will be twice as expensive as the domestic one. However, typically residents in a serviced apartment will receive water bills from the management which is charged a bulk meter rate by the water authority which is cheaper than a normal commercial property.

Assessment Rate

Local authorities in different areas have different rates on property assessment. For example, Majlis Bandaran Petaling Jaya (MBPJ) imposes a 6% assessment fee on stratified residential properties but charges a 6.6% fee for serviced apartments and 8.8% for SoHos.

Quit Rent

Quit Rent, or Cukai Tanah, is chargeable on a per square foot basis. It differs from state to state. In Kuala Lumpur, the rate is about RM0.035 per square foot per year. Typically for a serviced apartment owner the yearly amount will be roughly RM100 or only slight over due to its small size. Its amount is insignificant compared with other types of charges.

Can I apply to convert Electricity and Water charges to Residential rate?

For electricity, there have been cases of successful conversion from commercial to residential rate. Visit the nearest TNB office to your serviced apartment, ask for a sample letter template to write to TNB to request to convert to residential rate on the basis that the unit is occupied as residential unit.

For water, in a typical serviced apartment it is supplied by the management so there is usually not much owners can do about it. Note that management is charged at bulk meter rate which is typically cheaper than a commercial property anyway.

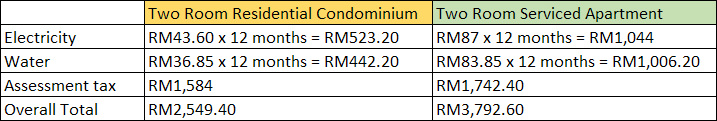

The Difference In The Numbers

Note:

Electricity: this is based on the assumption of 200 kWh usage per month, which equates to RM43.60 per month for residential condo and RM87 per month for serviced apartment

Water: based on Syabas estimation on a 31-day billing cycle

Assessment tax: based on assumption of a RM2,200 estimated monthly rent, for properties under MBPJ at 6% for residential condominium, and 6.6% for serviced apartment. Assessment rates vary for different areas.

Should I worry about the higher rate if my serviced apartment is on a commercial title?

It all boils down to your lifestyle and your goals in purchasing a property. Usually, a land is classified as commercial title due to its strategic location and thus enjoy a higher capital gain.

The reality is that as the nation or state develops, vacant residential lands will be only available further away from city area.

Typically, the difference in the rates per year between a residential vs commercial titled high rise apartment could be between RM1k to RM1.5k, however:

1) If you are buying for own stay and the location of the property will save you time traveling from work, consider the time saved for the 365 days by not having to get stuck in traffic.

2) If you are buying for investment, the capital gain for a property located in a strategic location per year will more than offset the extra you are paying in the rates.

How to get in touch with me:

Wesley Tan

+6017-688 9998

Https://bit.ly/wesphone

admin@wespedia.com

Comments